Great British Energy Strategic Plan

December 2025

Contents

- Foreword

- Executive summary

- Introduction

- Market assessment and analysis

- Our vision and mission

- Our aims and outcomes

- Our activity

- Our methodology

- Priority 1 - GBE Local

- Priority 2 - Onshore Energy

- Priority 3 - Floating and deepwater

- Energy, Engineered in the UK

- Delivering in collaboration with others

- Our people and values

- How we do business

- Measuring success

- Roadmap

- Glossary

- References

Foreword

Chair foreword

When Great British Energy (GBE) was launched back in 2024, it stemmed from a simple premise – that the British people should have a right to own and benefit from our natural resources. That these resources belong to all of us and should be harnessed for the common good.

Over the years we’ve seen an offshoring of the very assets and infrastructure that power our homes and businesses – deindustrialising at an alarming rate and watching as economic value left the UK to power economies elsewhere.

GBE’s goal is to redress that imbalance and become the UK’s energy champion, accelerating the deployment of clean energy technologies that benefit all of us.

This document goes some way to explaining the mechanisms and levers we can pull to bring about real change for the British people. It commits to the well-paid jobs we’ll create. It shows the technology areas that we’ll invest in. And it shows the supply chain interventions we can make to bring manufacturing back to our towns and cities.

This is part of a wider movement to create a new narrative around the energy transition, reframing it as the great economic opportunity of a lifetime rather than just bringing down emissions. It’s about being optimistic about energy as a driver of wealth and value, and - at its core - it’s about creating jobs, new industries, and lower bills.

But if history has taught us anything it’s that transitions don’t occur in isolation. An all-energy approach is one that benefits all people, keeping prices stable, jobs secure and industries afloat. Transitions are built on the backs of the previous system, calling for cooperation and collaboration.

It will take time, and it will take the patience of the British public before we fully see the benefits of a fully electrified, fully decarbonised and fully British-led energy transition.

Great British Energy will play a central role and act as the UK’s energy champion for many decades to come.

Juergen Maier CBE, FRS, FREng, Chair of Great British Energy.

Chief Executive foreword

Today, 250 years after the Industrial Revolution, we stand at the heart of another era-defining transformation: the energy transition. Few opportunities offer the UK such potential for leadership and pride. At a time when the nation seeks growth, prioritising innovation and investment in clean energy is simply good business sense.

Critics argue that the technology is made abroad, it’s too expensive, and the energy transition is not needed. This narrative is objectively untrue. The Department for Energy and Net Zero’s Public Energy tracker showed in summer 2025 that 79% of the British Public are concerned about climate change and that 80% support the use of renewable energy. To talk down our industrial potential in clean energy is to lack vision. The technologies driving the transition are diverse. Our expertise in offshore oil and gas positions us to lead in deep-water wind engineering— a race where our home city Aberdeen can thrive.

The UK remains part of a globally traded energy market, which means public finances can still be affected by swings in international prices. Therefore, building up more diverse domestic energy sources is important to provide households greater long-term stability. Climate Change is happening, and the UK has no other choice than to lead. GBE is about giving British people a stake in that leadership – a company to be proud of.

Our strategy is a work of engagement with industry, civic society and consumer groups, combined, underpinned by evidence and vision. It balances delivering short-term outcomes– especially in our GBE Local business – while helping to shape the future energy system. That means unlocking new industries and technologies that revitalise Britain’s industrial heartlands, stimulating growth and jobs in places where they are needed most.

GBE will give British people a share in the energy transition: unlocking the energy potential of public land; innovating new business models to enable low-cost renewable energy owned by communities; and breaking the frontiers of new technologies that we need to meet our targets. All of this underpinned by a £1bn investment into unlocking British supply chains so that our energy is engineered in the UK.

GBE is operationally independent and determined to champion the UK’s role in the energy transition. We want future generations to look back with pride that the UK took a leadership role in this era’s defining transformation.

Dan McGrail, CEO of Great British Energy.

Executive summary

Great British Energy: Clean, Secure, Yours.

Great British Energy (GBE) is the UK’s publicly owned energy company for a new era of national purpose.

Our mission

Our mission is simple and bold:

Public Ownership of Energy with Purpose: accelerate clean energy and the industries that support it to ensure workers and communities reap the benefits of clean, secure, homegrown energy.

For too long, the UK has relied on imported energy, while other state-owned companies have benefitted from owning our crucial energy assets. GBE represents a decisive break: a national energy champion that will plan, invest and build the infrastructure that powers our future and puts the British public at the heart of the energy system.

Public ownership with purpose means we use public capital to unlock private investment, not replace it. GBE will first and foremost be an energy developer, owning and operating assets while using investments to catalyse growth and build industries that last. Returns from assets the public owns are reinvested back into more capacity, more jobs, and more opportunity.

This is our first Strategic Plan. It sets out how the company is positioning itself to achieve its mission. We are starting by setting out our aims and targets for the next 5 years.

Our aims and outcomes

- Accelerate clean generation: Establish a portfolio through investment and ownership that will deliver at least 15 GW in clean energy generation and storage capacity and mobilise £15bn of private finance over time, through GBE spend between now and 2030.

- Power communities: By 2030, support over 1,000 local and community energy projects, boosting community ownership.

- Unlock the UK’s industrial base: Catalyse the just transition, funding projects to support at least 10,000 jobs by 2030, including skills and locations historically dependent on oil and gas. We will also launch a £1 billion Energy, Engineered in the UK programme to grow our clean energy supply chain.

- Deliver returns and long-term value: GBE will build a portfolio which is generating income by 2030 and be on a pathway to company-wide profitability.

Our activity

We will drive these outcomes by establishing our own project development function, giving the public a stake in assets across the development lifecycle.

Our initial investments will be focused on priority areas that will best deliver our aims across a balanced portfolio. Our priority areas are:

- GBE Local – the transformative force that makes local energy and community ownership commonplace, ensuring communities and public services directly benefit from the infrastructure they host.

- Onshore Energy – unlocking the energy potential of public land and investing strategically to deliver to the UK’s flexibility and grid stability needs.

- Offshore Energy – boosting jobs and growth in Scotland and the Celtic Sea by unlocking the next frontier in offshore wind: deeper waters.

Across all our priorities and beyond, our supply chain function will invest in initiatives to alleviate constraints, stimulate growth and contribute to the UK’s Industrial Strategy, delivering Energy, Engineered in the UK.

Introduction

Great British Energy (GBE) is a publicly owned energy champion, created to accelerate the deployment of clean energy technologies and to ensure UK taxpayers, billpayers, communities and the energy workforce reap the benefits of a clean and secure energy system.

Our ambition is to become a lasting national institution that the British public will be proud of: a developer, constructor and owner of homegrown energy that is Clean, Secure and Yours. From our base in Aberdeen, we are building GBE not just as a company, but as a cornerstone of the UK’s energy landscape: a trusted, transparent and innovative public champion that stands shoulder to shoulder with the leading state-owned energy companies of Europe. GBE will become recognised both at home and abroad as a world-class energy institution that embodies the values, expertise and ambition of the UK.

The Great British Energy Act, which received Royal Assent in May 2025, provided for the UK’s first publicly owned national energy company to develop, own and operate energy assets since the privatisation of the Central Electricity Generating Board in the early 1990s. The 2025 Spending Review allocated GBE and GBE-Nuclear over £8.3 billion to deploy towards our missions of delivering clean energy for the people.

- May 2025 – GBE Act receives Royal Assent

- June 2025 - £8.3 billion awarded to GBE and GBE-Nuclear in the 2025 Spending Review

- September 2025 - Statement of Strategic Priorities setting out GBE’s core objectives

- December 2025 - GBE’s Strategic Plan published

Note: Great British Energy and Great British Energy – Nuclear (GBE-N) will operate as two separate publicly owned companies with a shared mission to accelerate the deployment of clean energy assets. GBE will develop renewable and storage assets working in alignment with GBE-N, which will help deliver the UK government’s nuclear programme.

Our first Strategic Plan is our formal response to the UK government’s Statement of Strategic Priorities (SSP) for GBE1. The Plan sets out how GBE will achieve the objectives set out in the SSP. It explains how we will establish and scale our operations to achieve our mission and aims. It outlines the activities we will undertake and how we plan to operate.

Whilst we are wholly owned by the Secretary of State for Energy Security and Net Zero, we are operationally independent from UK government. This independence is fundamental to our role: it enables us to act as a trusted, expert body that can make impartial, evidence-based decisions in the energy market, in order to best achieve the objectives set out in the SSP.

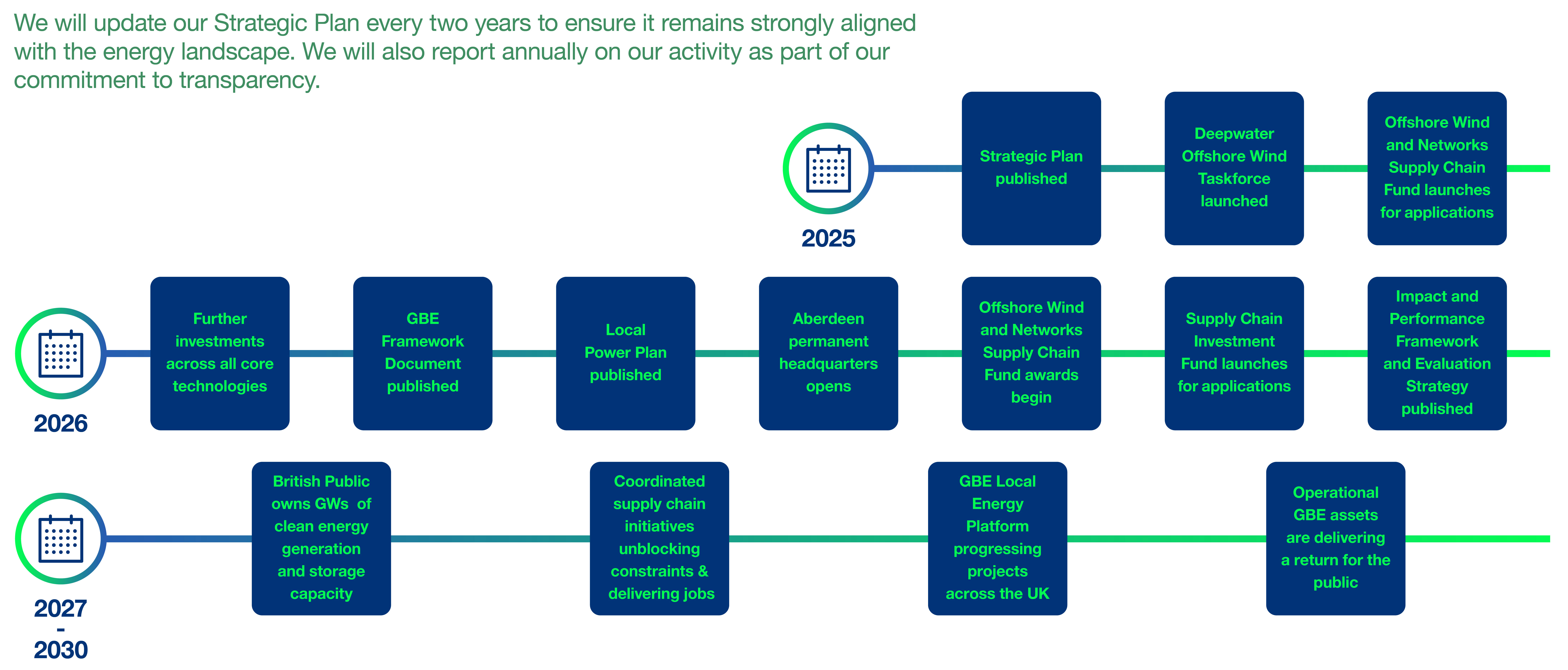

The Plan provides a starting point for GBE to become an enduring public institution, beginning with our aims for the next 5 years. We will update our Strategic Plan every two years to share our strategic approach and communicate our position to the market.

Whilst the purview of the plan is 5 years, we are very deliberately looking beyond 2030. GBE will help shape the energy landscape to 2035, 2050 and beyond, whilst keeping focus on what must happen now to unlock our future energy system.

We are just at the start of our journey, and we recognise that to create enduring impact we need to combine ambition with establishing our core competencies. These early years will be about building industry-leading expertise, establishing partnerships and laying a foundation of early commercial successes to build out from.

Developing our Strategic Plan

Collaboration is key to how GBE operates, utilising the best insights from public and private stakeholders.

In developing our Strategic Plan we have:

- Engaged with over 100 organisations

- Convened roundtables and workshops in Scotland, England, Northern Ireland and Wales

- Met with representatives across the energy and finance sectors, including developers, supply chain companies, investors and community energy projects

- Met with governments, partner organisations and relevant arm’s length bodies

- Delivered strategic plan focused meetings of our existing expert forums (Trade Union Advisory Council, Stakeholder Advisory Group and Aberdeen Taskforce)

Market assessment and analysis

Homegrown, clean and affordable energy will power the UK as we move away from reliance on volatile fossil fuel markets. Becoming a clean energy superpower will require the modernisation of the UK energy system. Our analysis considers this evolution, underpinned by the UK government’s Clean Power 2030 ambitions2, and framed in the longer term by scenario analysis from the National Energy System Operator (NESO’s) pathways to 20503.

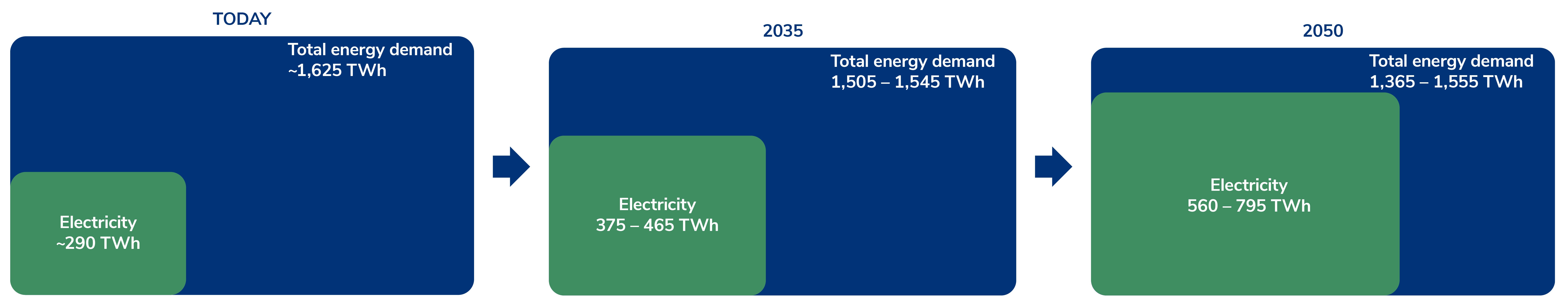

Today electricity accounts for around 20% of the country’s primary source of energy demand, but by 2050 it will be the primary source the energy powering our country. Electrification will cut across all parts of the economy, lowering emissions and increasing system efficiency. Clean electricity will power our transport, heat our homes, fuel our industry and support the expansion of new data centres, whilst delivering an estimated 60% of the UK’s emissions reduction by 20504.

GBE will be at the forefront of this transition, catalysing the investments and activity needed to meet the doubling of our electricity demand, and capturing the economic benefits for the British public in the process. We will align our actions with the UK’s Industrial Strategy5 and Clean Energy Industries Sector Plan6, bringing manufacturing back to our towns and cities to build the industries of the future.

Building an electricity system based on domestic renewable generation and storage capacity will make the whole UK energy system more secure and resilient. The International Energy Agency reports that the UK currently depends on imported fossil fuels for approximately 20% of energy related to electricity generation7. Without our own domestic renewables, this figure would be closer to 60%. This dependency on fossil fuels directly impacts the UK’s economy. Since 1970 over half of UK recessions have been caused by fossil fuel price shocks4. The energy transition will increase sovereignty whilst tackling climate change.

Supplying this growing electricity demand will necessitate an immense scale up of electricity generation. NESO’s scenario analysis indicates that by 2035, Britain may need around 83-175 TWh more electricity than we needed in 20248, dependent on the pace of decarbonisation. This is equivalent to the electricity demand of over 30 million UK homes9. By 2050, demand could be as high as around 800 TWh.

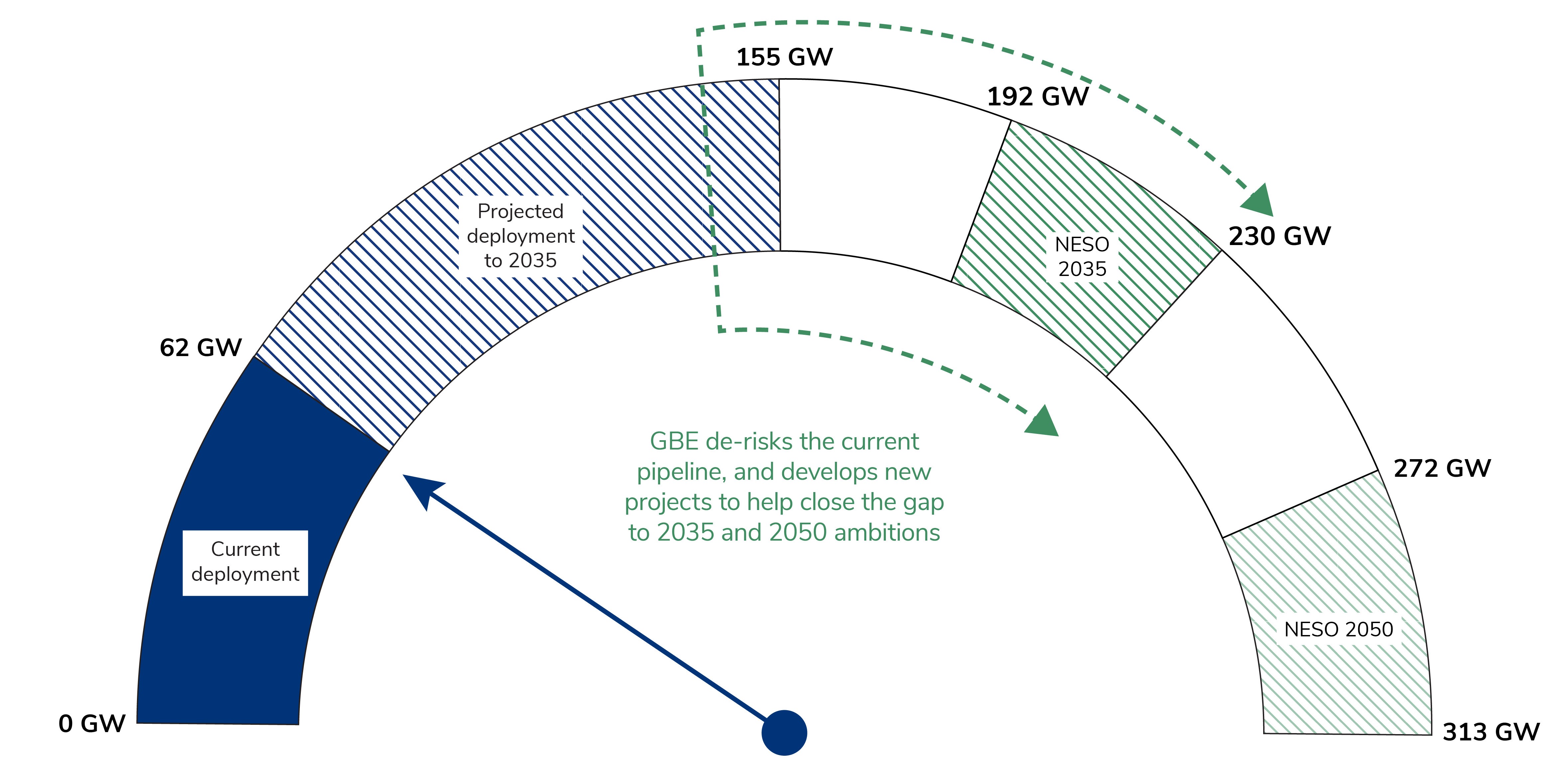

As electricity demand increases, we need to ensure that supply keeps pace. NESO estimates that by 2035 there could be a 20-35 GW shortfall in electricity generation capacity compared to their Future Energy Scenario (FES) pathways which set out a range of routes for meeting our 2050 net zero targets3.

NESO also produce a ‘slowest’ credible decarbonisation pathway which does not meet net zero by 2050. Even in this scenario, the shortfall in capacity could grow to up to 90 GW by 2050. There is a risk that without action, the UK will miss out on the opportunity that the energy transition brings. GBE will be part of the action needed to address this possible shortfall.

Figure 1: UK electricity and total energy demand over time to the nearest 5 TWh8

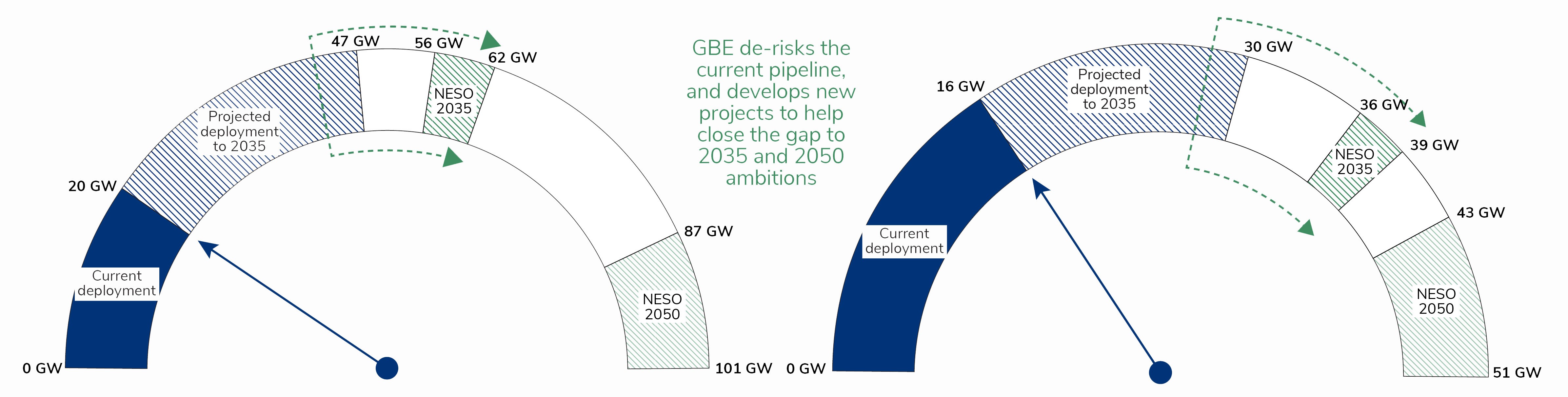

Key technologies are at risk of under-delivery. In NESO’s Future Energy Scenario pathways3,8:

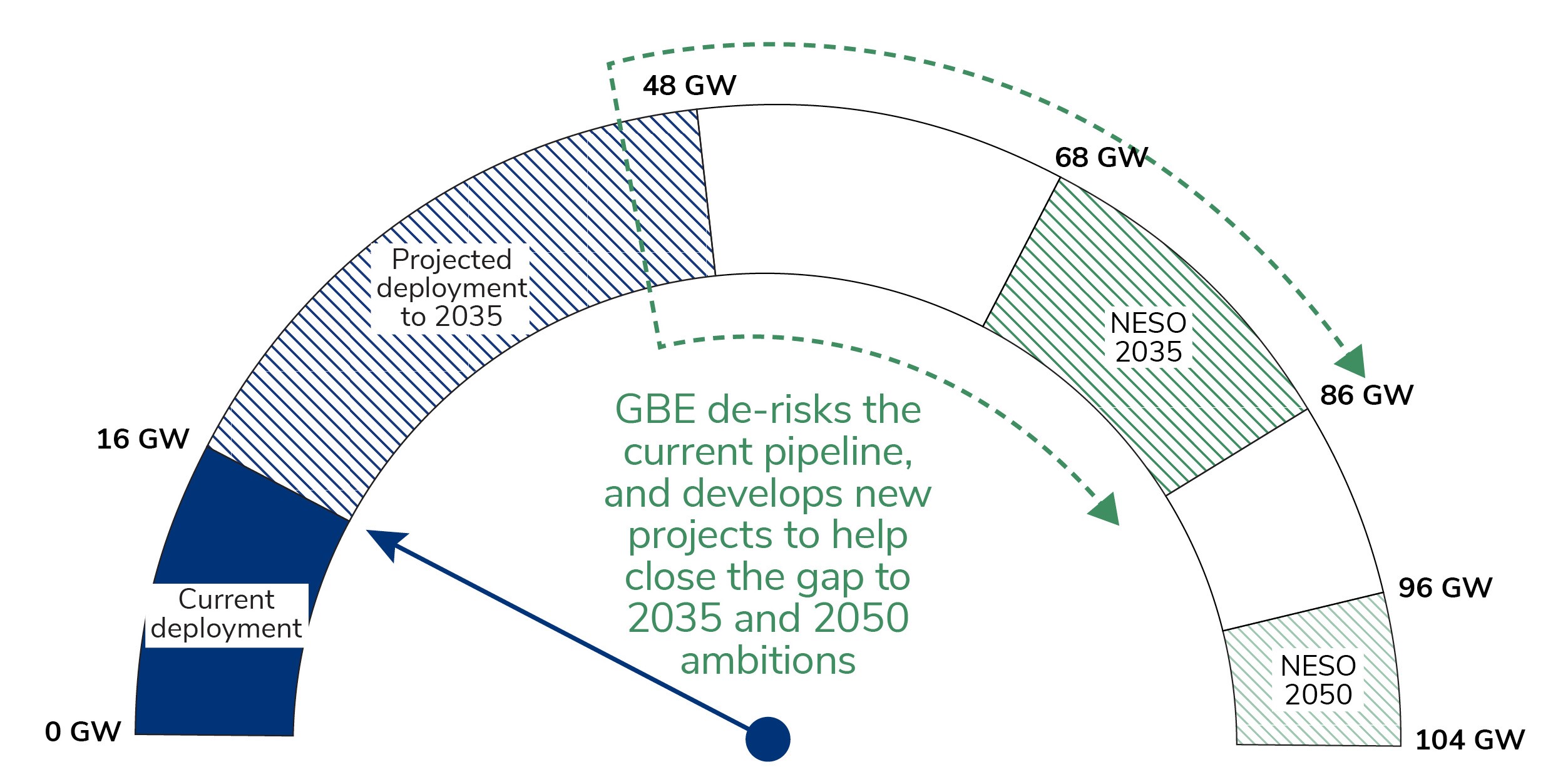

- Offshore wind capacity needs to grow up to five-fold by 2035, from 16 GW10 to 68 - 86 GW. Deepwater offshore wind is expected to contribute to this, however, only 80 MW11 is currently deployed in the UK. GBE can help unlock the UK’s potential and build on the success of fixed-bottom offshore wind.

- Onshore wind and solar capacity also need to vastly increase. 16 GW of onshore wind is currently deployed in the UK10, and 36 – 39 GW is anticipated to be needed by 2035. There is an even larger gap for solar, with 20 GW12 needing to ramp up to 56 – 62 GW total capacity by 2035. GBE can support this by unlocking public land, as well as private land ventures, and repowering existing onshore wind sites.

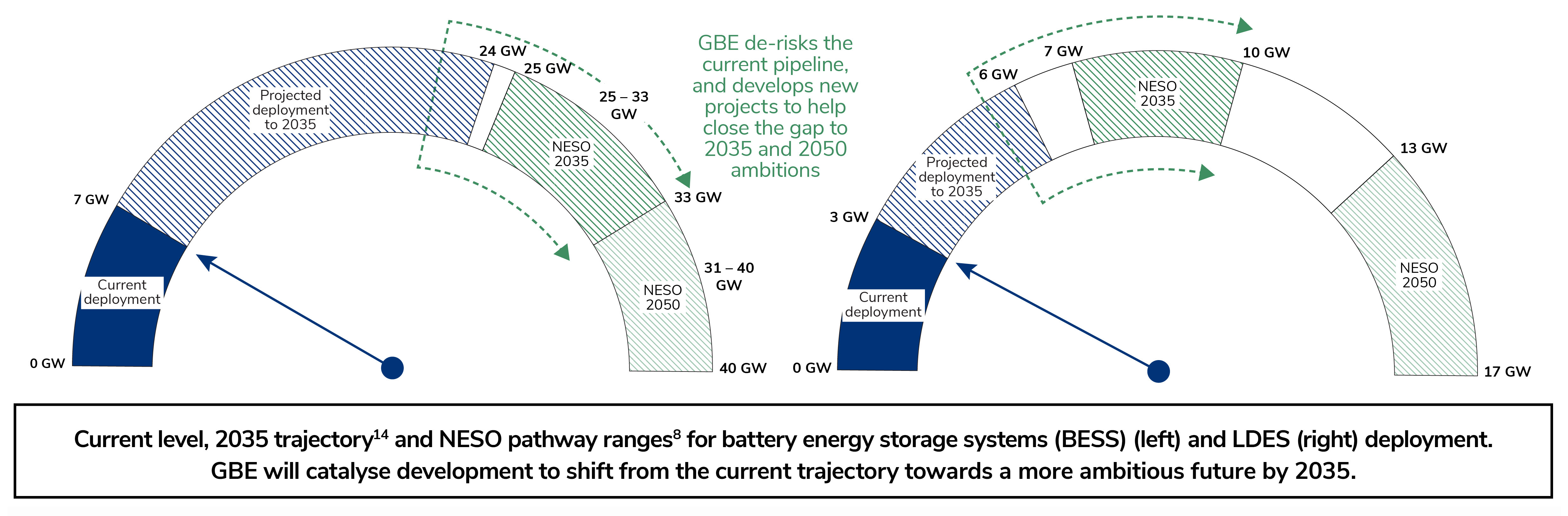

- Demand for energy storage, including battery energy storage systems (BESS) and long duration electricity storage (LDES) is expected to more than triple, with 25 - 33 GW of BESS and 7 - 10 GW of LDES capacity needed by 2035. This compares to an existing capacity of just 7 and 3 GW respectively13. GBE can help accelerate deployment across BESS, Pumped Hydro Energy Storage (PHES) and nascent LDES technologies.

GBE’s key focus, at a strategic level, is to work with the private sector to de-risk the pipeline that already exists and originate new projects that fill the gap to the upper reaches of the UK’s ambitions for clean energy.

Figure 2: Current level, 2035 trajectory14 and NESO pathway ranges8 for renewable deployment in GBE priority technologies.

GBE will support delivery of the existing pipeline of projects and catalyse new development to close the gap between the current trajectory for deployment and the 2035 and 2050 demand under NESO FES pathways.

Our vision and mission

Our Vision

Great British Energy: Clean, Secure, Yours.

Our Mission

Public Ownership of Energy with Purpose: accelerate clean energy and the industries that support it, ensuring workers and communities reap the benefits of clean, secure, homegrown energy.

Our vision and mission

Great British Energy has a vision: to become an enduring institution that delivers the benefits of a cleaner, more secure energy system to the UK public. Energy powered by purpose, owned by the people and dedicated to unlocking the UK’s potential in an electrified world. That’s Great British Energy: Clean. Secure. Yours.

To realise this vision, we are orientating our activities and decisions around achieving our mission:

Public Ownership of Energy with Purpose: accelerate clean energy and the industries that support it, ensuring UK workers and communities reap the benefits of clean, secure, homegrown energy.

Public ownership with purpose means delivering outcomes through utilising the qualities and incentives that GBE has, that are not shared by other companies and organisations. These qualities will complement and enhance activity in the sector boosting deployment and modernising our energy system. We will align with the strategic objectives set out in the Industrial Strategy5, its Clean Energy Industries Sector Plan, and the Clean Energy Jobs Plan15 as well as future UK government strategies and publications such as NESO’s Strategic Spatial Energy Plan16.

What makes us different

GBE’s success will be measured by more than returns

Wider public benefit through a better, more affordable energy system and good jobs. We will mobilise investment from other developers and finance institutions – both public and private, domestic and international – as well as from local and community funding, to bring these opportunities to the UK.

GBE will have a different risk appetite, seeking wider benefits

GBE will invest responsibly, seeking returns whilst embracing balanced risks associated with market, business model and/or technological nascence. We will evaluate returns in the broadest sense, considering the social good and wide-ranging impact of our investments over the long term.

We will coordinate between private and public sectors

With a more patient investing strategy that will unlock critical supply chain constraints and enable the country to benefit from the economic opportunity tied to the energy transition.

GBE will partner with community energy groups and local authorities

Offering a toolkit of advice, guidance, templates and industrial expertise to unlock greater community stakes in clean energy. GBE will also offer opportunities for community benefit and shared ownership through its own portfolio of projects, and demonstrate best practice.

We will reinvest returns to support the public good

As a publicly owned company, we will reinvest returns to increase both the impact we make, and the good we deliver. Retaining and reinvesting profits in the long run will compound progress and accelerate the energy transition.

Our aims and outcomes

Success for GBE will mean leveraging our unique qualities and turning them into an actionable plan to deliver results. Reflecting the strategic objectives set out in the Statement of Strategic Priorities, we have four key aims to achieve in the next 5 years:

Aims

Accelerate the overall deployment of clean energy

- Establish a portfolio that will deliver at least 15 GW through investment and ownership in clean energy generation and storage assets

- Mobilise £15bn of private finance over time from GBE funds committed between now and 2030.

Increase local and community ownership of clean energy

- Support over 1,000 local and community energy projects, boosting community ownership.

Support jobs and the growth of British manufacturing and clean energy technology

- Catalyse the just transition, funding projects to directly support at least 10,000 jobs, including skills and locations historically dependent on oil and gas.

Invest on commercial terms, reflecting risk weighted returns relevant for the sectors we are targeting

- Build a portfolio which is generating income by 2030, and be on a pathway to company-wide profitability.

Outcomes

Aim 1 outcomes:

- Drive public ownership with purpose, giving people a lasting stake in the UK’s clean energy future.

- Deliver a cleaner, more secure system that supports economic growth.

- Expand access to electrification of everyday life, helping households and businesses switch to clean power.

Aim 2 outcomes:

- Enable communities to directly benefit from direct ownership of assets and shared ownership projects.

- Lower energy costs for key public services like hospitals and schools, releasing resources for frontline delivery.

- Broaden access to low-cost renewables and smart local energy systems that make regions more self-sufficient and resilient.

Aim 3 outcomes:

- Create and sustain high-quality jobs and apprenticeships, with strong union representation, in areas of the country that need them most.

- Create opportunities for workers to move into the green economy, helping to build the skilled workforce Britain’s energy transition requires.

- Stimulate new markets and technologies in which the UK can compete and lead globally delivering on the UK’s Industrial Strategy.

Aim 4 outcomes:

- Ensure benefits returned to the public will compound over time through reinvestment in further clean energy capacity.

- Achieve GBE’s financial independence while strengthening the value of publicly owned energy assets for future generations.

Measurable impacts lead to real-world outcomes. GBE will publish an Impact and Performance Framework, outlining how impacts will be considered and evaluated by the organisation.

GBE’s impact on energy costs

Reducing energy costs is a national endeavour. The UK government will play an essential role, with GBE’s activity designed to complement this action. GBE will create direct impact through our local and community activities and, in the longer term, through driving cost reduction in new technologies and investing in projects that will make our energy system more efficient.

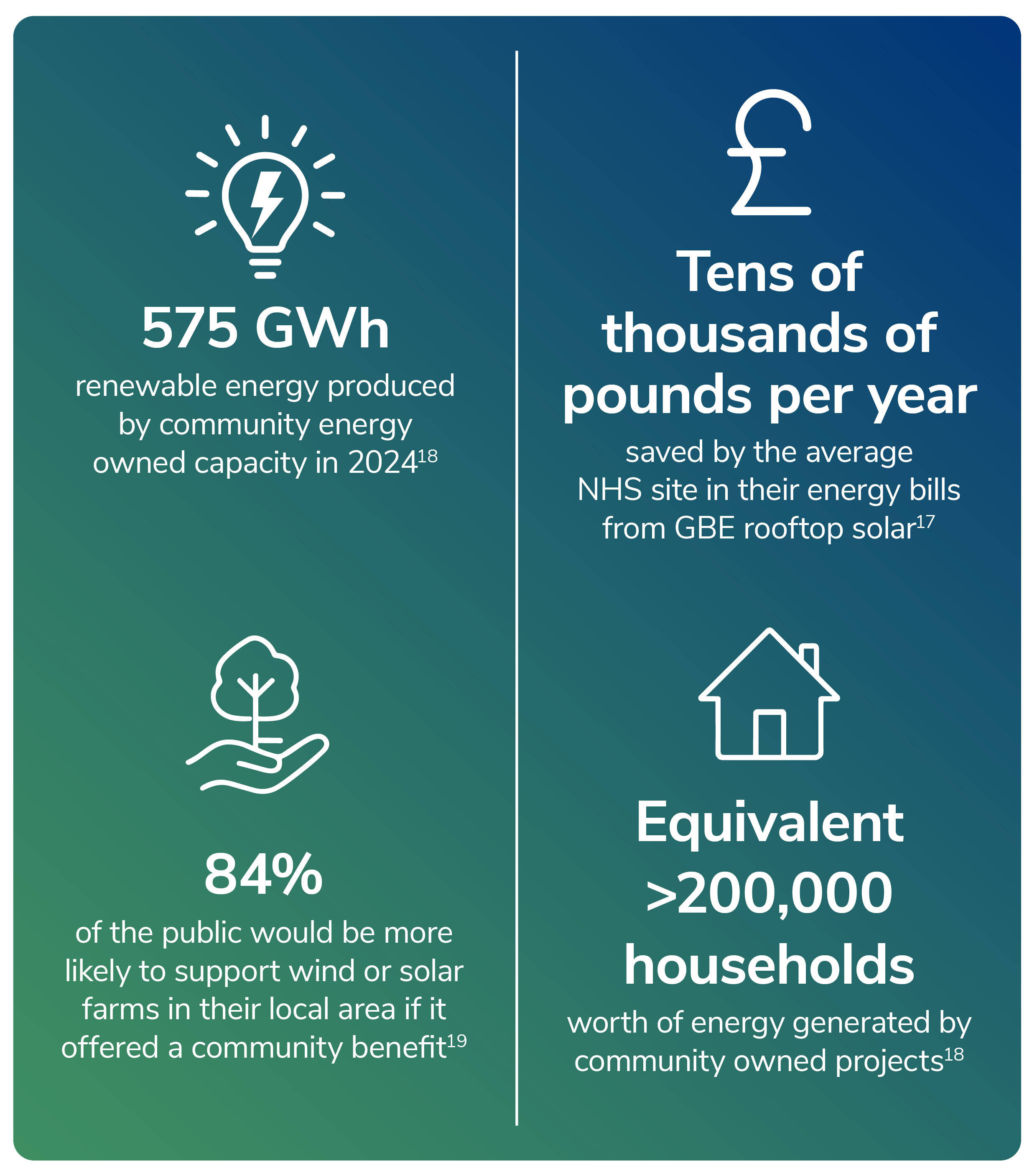

GBE supports the installation of renewables at schools, hospitals and public buildings, connecting low-cost energy to communities. GBE’s existing partnership with the Department for Education and the NHS has potential to deliver lifetime savings of hundreds of millions of pounds off energy bills, saving a typical school or hospital tens of thousands of pounds per year17.

Where community energy is deployed, groups will have the ability to redistribute earnings from these assets back into the participating communities. When we get this right, investing in energy can unlock better outcomes on the things that really matter for people – health, education and wellbeing.

Taking a long-term, cross-sector view, GBE will locate its generation and storage assets in a way that aligns with the system. Investing in flexibility will capture greater value from our existing assets and reduce the pressure on network reinforcement. This will benefit the system, industries and the billpayers.

We will also catalyse long term cost reductions in offshore energy, with nearer-term wins for the British public via good quality jobs in supply chains through our Energy, Engineered in the UK £1 billion fund.

Our activity

GBE’s initial capitalisation will be utilised across various business activities to support clean energy development. We anticipate having different roles in different sectors, initially with minority equity in nascent technologies and more majority stakes in mature technologies.

- Energy Developer: First and foremost, GBE has been established as a developer of clean energy projects. We will lead the development of clean energy assets from inception, owning and operating these assets for the taxpayer. Majority ownership of established technologies can bring stable returns and close deployment gaps. We will develop with partners and bring benefits to local communities.

- Strategic Investor: Our investments will complement our development activity. We will target projects where GBE can de-risk and attract wider capital. We will be an active investor, learning from each venture to build expertise and support our development arm. Not all our activities will be commercial: grants and loans will be deployed strategically where they will help us achieve our aims.

- Market Coordination: Our financial activity will be supported by initiatives that further the delivery of our mission through enabling wider deployment. That will include capability support to community and local energy groups, and market-shaping initiatives that help coordinate government policy with public and private investment.

These roles will be undertaken within GBE’s core priority areas:

- GBE Local: The transformative force that makes local energy and community ownership commonplace, ensuring communities and public services directly benefit from the infrastructure they host in supported generation and flexibility assets, across our total project pipeline

- Onshore Energy: Unlocking the energy potential of public land and investing strategically to deliver on the UK’s flexibility and grid stability needs.

- Offshore Energy: Boosting jobs and growth in Scotland and the Celtic Sea by unlocking the next frontier in offshore wind: deeper waters.

- Supply Chain – Energy Engineered in the UK: Underpinning our clean energy deployment with a comprehensive, complementary supply chain program to unlock industrial opportunities from the energy transition and to ensure the UK develops enduring capabilities in clean energy technologies.

Our methodology

Deploying our capital to maximise the impact we have means focusing on the sectors where public ownership with purpose can have greatest impact. By focusing our efforts, we can build expertise and core competencies quickly and use these to be a more effective delivery partner and clean energy champion.

Whilst being operationally independent, we will operate within the mandate set out in the SSP. We will invest in, develop, own and operate electricity generation projects, doing this in tandem with our activity in clean energy supply chains. We do not have plans in this phase to become an electricity retailer selling power to domestic users directly, nor do we foresee GBE developing or directly investing in large-scale network or grid infrastructure.

Our shortlist of priority technology areas has been identified through a combination of market engagement and portfolio modelling. We have considered which technologies best balance the aims of the company and provide opportunities for GBE to utilise its unique role.

We will evaluate projects and ventures on a case-by-case basis while continuing to monitor market trends. The priority technology areas listed in this plan are where we will focus our efforts initially. We may amend our areas if there are opportunities to better meet our ambitions as markets evolve.

Analytical approach

Our high-level process for identifying priority areas:

Identification of technologies aligned with GBE’s mandate

Assessment of criteria to determine how well technologies fit with GBE’s strategic objectives

- Extent technology is needed for net zero

- Maturity of technology

- Technology pipeline and pipeline certainty

- Ability for GBE to crowd in others

- Scope for community benefits

- Opportunity to support jobs/economic growth

Portfolio modelling to assess impact and trade-offs, informing technology choices and investment strategy:

- Assign GBE’s entry point and unique role

- Build archetypical portfolios

- Assess commercial and social outputs

Priority 1 – GBE Local

Transforming local and community energy ownership.

GBE Local - Context

GBE Local will enable the rollout of a new era of community and local energy projects across the UK in the near term, whilst developing longer-term, scalable models to unlock the value of local energy.

Context:

The development of smaller, more modular electricity generators, like solar PV and wind, has created new opportunities for less centralised and more democratised ownership. This includes projects owned by community groups, co-operatives, local government and commercial organisations.

At their heart, community energy projects involve groups of people coming together to purchase, manage, generate or reduce consumption of energy within a specific area, such as a town, city or region. It typically involves local generation (like solar panels, wind turbines or small-scale hydro), local demand (homes, businesses, public services), and sometimes storage and smart technologies to balance supply and demand.

The UK’s pathway to a net zero, resilient, and affordable energy system will not be achieved through centralised strategies alone. Communities are at the heart of the UK government’s mission to make the UK a clean energy superpower and need to be able to benefit from the infrastructure in their local area. To achieve this there is a need to establish long-term investor and community confidence.

GBE Local statistics at a glance:

Challenges:

A number of well-understood barriers are preventing the scale up of local and community energy projects, which GBE can have a central role in addressing. The smaller scale of local energy projects and their heterogeneity in terms of technology used, site configuration, location and commercial structure introduces a number of interlinked challenges:

- Access to development capability: some groups lack the technical, legal and commercial expertise needed to take projects from concept to operation, restricting the pace and scale of project development.

- Lack of route to market, including system flexibility: community and local energy projects face difficulties securing bankable offtake arrangements, facing challenges with power purchase agreements (PPAs), grid access and participation in flexibility or capacity markets. This undermines project viability.

- Access to finance: as a result, community groups and local authorities often struggle to raise early-stage development and construction finance, as projects are perceived as higher-risk and lack collateral.

GBE Local - How will we differentiate?

By overcoming the barriers faced by local and community energy projects, GBE will accelerate deployment, drive more clean energy generation, and contribute to our aim of increasing local and community energy ownership.

The Scottish and Welsh Governments have already set ambitions for 2 GW20 and 1.5 GW21 of community-owned energy respectively. GBE Local will build on the appetite from the sector, working collaboratively with devolved governments to drive forwards clean energy initiatives in all four nations.

Realising the full value of distributed energy technologies means unlocking the full potential of onsite and behind-the-meter generation and maximising community and local benefit. Working across the public sector and communities, GBE will develop a range of interventions and products that address the unique challenges facing local and community energy in these settings and will work to identify the common solutions that can be used as a platform for scaling up delivery.

Alongside immediate actions to scale up local energy projects, GBE will also work in partnership with the UK government to develop and deliver the Local Power Plan. The Local Power Plan will aim to address some of the systemic issues facing the sector such as the challenges with local and community energy realising the value they deliver as well as addressing immediate needs to develop the pipeline of community and local energy projects.

GBE Local contributing to lower bills

Renewable assets like rooftop solar or small-scale wind can deliver an immediate reduction in community bills. This is done by directly offsetting grid electricity use or through the distribution of community benefits, as funds, from these projects. When GBE helps deploy or finance rooftop and local distributed generation nearer to the point of use, this can reduce the need for network reinforcement. Opening up flexibility markets for assets to respond better to local price signals can unlock value and lead to an overall reduction in system cost.

Case study: GBE’s solar scheme

Hospitals and schools across the country are cutting their energy bills thanks to a £255 million investment from Great British Energy and the UK government22.

In total the scheme will be supporting around 250 schools, over 270 NHS sites and around 15 military sites across the country.

Thanks to Great British Energy, millions could now be invested back into frontline services in deprived areas – as the rollout continues on a scheme that will see lifetime savings for schools and the NHS of hundreds of millions of pounds.

Case study: GBE Community Fund

The Great British Energy Community Fund is our first grant programme for community energy projects. It is designed to:

- Support communities: By helping them maximise the income-generating potential of renewable energy and put this to work in their areas.

- Increase energy generation: Make progress against the UK government’s target to increase renewable energy generation and promote community-owned renewable schemes.

- Promote growth and job creation: To enable communities to access the economic benefits associated with renewable energy schemes.

GBE Local - Our role in the Local Power Plan

GBE will publish a joint Local Power Plan (LPP) with the Department for Energy Security and Net Zero in 2026 that will outline our shared long-term vision the local and community energy.

What the Local Power Plan is

The Local Power Plan will set out GBE’s and the UK government’s shared ambition for the growth of local energy, including through the growth of local government renewable generation and the community energy sector. Recognising the value that more community and public sector ownership provides, the LPP will ensure people feel the benefits from infrastructure in their local area. The LPP is also important for the UK government’s Clean Power 2030 ambitions2.

The LPP will build on the foundations established by GBE in 2025/26, including funding for solar on schools and hospitals as well as support for renewable deployment within Mayoral Strategic Authorities and community energy groups. It aims to clarify the roles and responsibilities of GBE, the UK government and other key partners. The goal is to provide cleaner, more affordable and more resilient energy at the community level.

The Local Power Plan will seek to address the key barriers holding back the development of community and local energy, combining the UK government’s role to unlock policy and regulatory barriers with GBE’s role in supporting local government, communities and the public sector to address capability and capacity, and funding and finance barriers. All this will culminate in achieving our aim of increasing public participation and benefit from the energy transition.

The Local Power Plan will realise the benefits of local and community energy

Increasing communities’ engagement in the energy transition fosters social benefits which engender social acceptance and develop trust23. This can in turn foster greater community support for clean energy projects than commercial projects24,25, reducing opposition that can delay the transition. DESNZ’s Public Attitudes Tracker reported that more than 8 in 10 people would be more likely to support a wind or solar farm in their local area if it offered a community benefit19.

Additionally, community ownership of renewable energy provides additional capital to the market26,27 through Community Share Offers, reducing developer capital expenditure (CAPEX). It places ownership in the hands of the British people, democratising ownership and increasing British ownership of public assets28.

Distributed local energy generation can bolster the UK’s energy system resiliency, lowering the cost of curtailment and reducing the likelihood of energy shortages29.

Giving communities and local people a direct stake in clean energy infrastructure is key to unlocking the full opportunity of the energy transition.

GBE’s role in delivering the LPP:

- Grants, loans and blended finance: GBE will support an increase in community ownership and community benefits through initial grants, concessional loans, shared ownership models and blended finance. As a partner to the UK government in the LPP, GBE will have a role enabling communities to own and operate their own energy assets.

- Build capability: In addition to funding, GBE will build capability in-house as well as through a network of partner organisations, making use of their expertise to support community energy organisations to develop projects across the UK.

- Policy: Supporting policy makers to design effective policy to facilitate local energy deployment and make our shared vision for community and local energy a reality.

GBE Local - Our investment approach

To complement our role in the LPP, GBE will develop a commercial platform to unlock the potential of local energy for a range of organisations.

Our vision for GBE Local:

- Create an open-access platform which makes developing and owning local energy easier.

- Unlock the burgeoning potential of local energy to play a vital role in our energy system and in communities.

- Engage the public in the energy transition, ensuring the benefits are there for all to see.

GBE Local Energy Platform:

Our commercial offer for onsite generation

Our GBE Local platform will provide an end-to-end business solution for onsite generation. It will be a shop window, open to any consumer groups with a desire to develop onsite energy generation at scale.

This will include community organisations and local government, but would also be open to commercial buildings, social housing and NHS trusts. GBE’s unique role here will include:

- Aggregation: Leveraging the public sector’s buying power and standardising technologies where possible to enable smaller projects to access suppliers and benefit from economies of scale.

- Accredited delivery partner network: Build a network of trusted delivery partners that will manage the works, facilitating project delivery.

- Financial solutions: Develop potential business models for projects that will enable GBE to offer a commercially viable, differentiated and enduring model as the sector develops. This could include GBE equity, PPA support or virtual power plants.

Energy, Engineered in the UK

Installing clean energy requires a skilled workforce. As we establish a delivery partner network our GBE Local Platform will support jobs and opportunity across the UK.

GBE Local: Our long-term approach

GBE Local will deliver in phases, leveraging partnerships to establish early wins, whilst also strategically planning for the longer term.

Strategic partnerships

Our partner network will be established to enable GBE to deliver its products and provide access to a larger range of skills and expertise than it could develop in-house. It will also enable GBE to have local economic impact by working with regional organisations and SMEs.

This will include:

- Strategic Partners: Together, we will overcome barriers and develop new delivery models.

- Delivery Partners: Companies and organisations we will work with to deliver local energy projects.

- Local Power Plan Partners: Organisations we work with to ensure the success of the LPP.

Phase 1

- Collaborate and form partnerships. No one organisation can tackle this problem.

- Development funding offer to stimulate community and local energy pipeline.

- Form a number of initial agreements with Mayoral Combined Authorities (MCA) and local authorities to pilot projects, establishing our offering and learning what works and what doesn’t.

- Build our expertise and knowledge in how to make community and local energy projects commercially viable.

Phase 2

- Establish a route to market for unlocking smart local energy solutions up and down the country.

- GBE Local energy platform is fully operational and supporting projects across the development cycle.

- Distributed energy is on track to being a cornerstone of the energy transition. The public can see the benefit their assets are bringing.

- GBE supported community-led projects are enabling communities to reap the benefits of clean energy ownership with new operational assets.

GBE Local Energy - Summary

Why GBE Local?

- Communities are at the heart of the energy transition, and becoming a clean energy superpower means giving local people and businesses the ability to benefit directly from clean energy infrastructure.

- Each local energy project is unique, and GBE has the opportunity to address the barriers that can arise as a result of this, providing capability and securing routes to market to unlock access to capital.

How will GBE differentiate and invest?

- The LPP will set out our role within a long-term vision for the local energy sector, providing grants, loans and blended finance to enable communities to own and operate energy assets.

- We will create a GBE Local platform, providing end-to-end support for consumer groups to pursue onsite generation: enabling smaller projects to access suppliers, building a network of delivery partners and providing financial solutions to ensure commercial viability.

Partnerships

- We will partner with community energy groups, empowering them to capture the benefits of distributed energy.

- Delivery partners will enable us to deliver our products and provide a larger range of skills, expertise and support.

Outcomes

- Enable communities to benefit directly from the infrastructure they host through GBE Local and shared-ownership projects.

- Lower energy costs for key public services like hospitals and schools, releasing resources for frontline delivery.

- Broaden access to low-cost renewables and smart local energy systems that make regions more self-sufficient and resilient.

- Expand access to electrification of everyday life, helping households and businesses switch to clean power.

Priority 2 – Onshore Energy

Unlock the energy potential of public land. Catalyse the flexible energy systems of the future.

Why Onshore Energy?

Onshore renewables including onshore wind, solar photovoltaic (PV), and battery energy storage systems (BESS), will be a cornerstone of future electricity systems. Now among the cheapest sources of power, they will strengthen resilience against fossil fuel price shocks and can be deployed close to demand, reducing the need for network infrastructure.

Solar and onshore wind are therefore critical generation technologies to the UK government’s ambitious net zero deployment trajectories. NESO’s pathways require up to 62 GW of solar and 39 GW of onshore wind capacity by 20358, up from 20 GW and 16 GW respectively today10,12.

GBE will bolster deployment by developing projects that would not otherwise happen, while also establishing robust revenue generation from lower-risk onshore projects as key components of our diverse technology portfolio. Our activity will materially impact 2035 deployment and beyond, with successful early investment supporting the UK government’s Clean Power 2030 ambitions.

Figure 3 & 4: Onshore energy statistics (solar). Onshore energy statistics (wind).

While deployment continues at pace, there are risks that these ambitious levels do not materialise. GBE has worked with expert market analysts to understand likely deployment trajectories for onshore technologies14. This analysis suggests potential shortfalls in capacity of 11 - 15 GW of solar, and 6 - 9 GW of onshore wind by 2035, against NESO’s net zero pathways.

With up to 60% of existing onshore wind capacity reaching the end of its life by 204030, repowering of existing sites to maximise benefits from the existing project pipeline will also be crucial to maintaining deployment progress.

Onshore Energy - How we will differentiate

GBE is uniquely positioned to originate and own a new generation of utility-scale onshore clean energy projects, unlocking public land and recycling revenues back to the transition.

The Opportunity

There is a unique opportunity for GBE to become the UK’s public energy developer, originating new onshore projects to bolster deployment.

Onshore assets, particularly solar PV and BESS, have some of the shortest development timelines of all utility scale technologies. This provides the opportunity for outcomes to be realised quickly.

What’s more, established technologies can be used to balance risk across our portfolio, enabling us to build steady, predictable returns allowing us to be more aggressive in pursuing higher-risk innovative technologies in turn.

We recognise the importance of GBE focusing our efforts on delivering projects and outcomes that would not have occurred otherwise, but we will also look to capitalise on opportunities to invest in and own assets that can deliver stable returns in the near term.

GBE can unlock project origination opportunities, for example on public land, and we will look to develop assets with strong community focus and participation, utilising our experience and network developed through GBE Local.

Public Land Opportunity

Public land provides one of the largest untapped opportunities for onshore renewables in the UK for GBE. We are uniquely positioned to realise its potential as a developer, overcoming a combination of coordination and regulatory challenges. Public ownership of assets on public land offers clear benefits, including:

- The public capturing the value of the land and operational revenues.

- Potential for strategic coordination across public lands in line with NESO’s SSEP.

- Enhanced environmental and community stewardship.

Initial geospatial analysis of central UK government landowners identified up to 330km2 of land which could be suitable for onshore renewables14. Further analysis of viability and exploration with other public landowners is underway.

By unlocking development on the public estate, including land owned by the UK central government, devolved governments and local authorities, GBE has the potential to make a critical contribution to clean energy deployment.

Through development on public land, GBE has the unique ability to mobilise private capital into new, emerging opportunities. This collaborative approach will also help address unique challenges the public sector has had with creating viable business models, such as a lack of capital and borrowing restrictions.

Up to 330km2 of UK government owned land could be suitable for onshore renewables.

Onshore Energy - Our investment approach

GBE will take different approaches in different sectors to own and operate assets on behalf of the public, whilst also playing a critical role building momentum through its investments.

Our vision for onshore energy

- Establish, in the medium term, a fully-fledged Independent Power Producer business.

- Build development capability to unlock the energy potential of public land.

- Establish expertise across a range of generation and energy storage technologies.

Energy, Engineered in the UK

- Unlocking new opportunities to boost onshore renewable deployment will reinforce supply chains and support engineers and installers.

- Capturing early-mover advantage on emerging technologies provides a platform for UK business to capitalise on a growing global need for clean long-duration electricity storage (LDES).

Onshore development

Our focus will be initiating, developing, owning and operating clean energy projects in established technologies which have existing routes to market. We may do this on our own or in partnerships and joint ventures with others, acquiring and developing the necessary in-house capabilities.

Development across the lifecycle:

We will undertake lucrative, large-scale, new development opportunities with ability to hold or sell down capital in areas identified as strategic priorities. Repowering of existing sites offers an opportunity to maximise benefits from the existing onshore wind project pipeline. GBE will also look to co-invest in the later development phase to build expertise and strengthen revenues.

Unlocking public land opportunities:

We will prioritise overcoming a combination of coordination and regulatory challenges, to unlock development on public land.

Local and community opportunity:

GBE will play a leading role with local energy groups, in providing shared ownership structures and community benefits, engaging proactively with the domestic supply chain and the communities hosting clean energy assets.

GBE will seek alignment with NESO’s Strategic Spatial Energy Plan (SSEP)16 to ensure our projects are optimally located for the benefit of the energy system. GBE’s activities will seek to mitigate grid constraints, reducing system costs and providing local system benefits to deliver cleaner and more resilient energy systems.

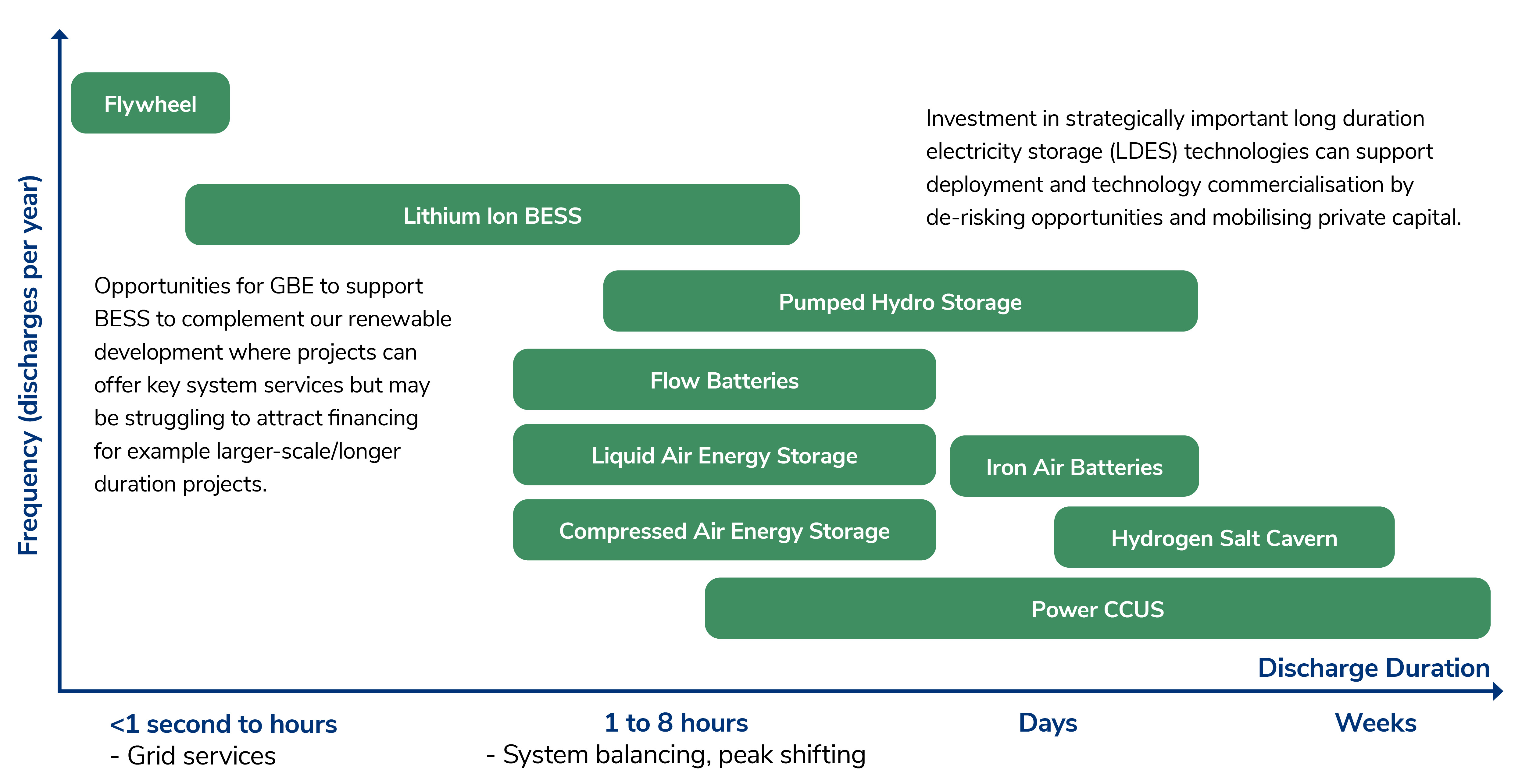

Onshore energy: Why storage?

Investing in low carbon flexibility complements our renewable assets, allowing us to build a balanced portfolio that delivers the greatest system value.

Context

Storage assets balance the grid by generating electricity when the country’s demand is low and discharging it when demand rises again. These assets play a vital role, complementing renewable technologies which generate electricity intermittently based on our weather.

Our clean energy system needs storage assets that charge and discharge quickly to provide grid services and short-term balancing, as well as storage that can store and discharge energy over longer periods to cover windless spells.

NESO’s pathways require up to 33 GW of short duration batteries, generally lithium-ion batteries, by 20358, compared to the current capacity of 7 GW. In addition to this, those pathways estimate up to 10 GW of long duration electricity storage (LDES) capacity being required by 2035, up from 2.7 GW today13.

LDES is an umbrella term which encompasses a variety of different technologies, ranging from early-stage concepts all the way to successfully proven technologies with Technology Readiness Level (TRL)9.

Figure 5 & 6: Onshore energy statistics (BESS and LDES)

The Opportunity

Whilst short duration storage is an established technology, there are opportunities for GBE to de-risk high delivery ambitions.

Similarly, while the UK’s first LDES cap and floor scheme31 aims to unlock critical technologies such as PHES, with the first window looking to support 2.7 - 7.7 GW in new LDES capacity, by de-risking revenues, it cannot fully mitigate the barriers to LDES deployment. This means there are opportunities for GBE to play a role:

- Magnitude of risk and funding needed for large scale storage: GBE will consider its role in giving confidence to the market to bring forwards such technologies with significant upfront capital requirements, facing long construction times, with supply chain constraints challenging delivery pathways.

- Nascent technologies needed for net zero: GBE will also explore supporting nascent LDES technologies carrying higher risks, including lower technology readiness, supply chain volatility and operational risks – all impacting investor appetite. Establishing domestic expertise in more nascent LDES technologies could provide IP and export opportunities as technologies mature. However, these technologies carry higher risks, including lower TRLs, supply chain volatility and operational risks – all of which impact investor appetite.

Onshore Energy: Our investment approach to flexibility and storage

A high-level snapshot of a range of flexible technologies, recognising technology development has potential to evolve their roles in the market.

Our role in flexibility

We will seek to crowd in private sector capital for established technologies whilst also de-risking projects at different stages of maturity to balance nearer term revenue generation, with longer-term learnings and grid security.

Accelerating and mobilising significant private capital

- Support near-term deployment of projects by investing capital to de-risk development projects, acting as a cornerstone investor to mobilise private capital.

- We will look to sharing project development, building valuable capabilities in the flexibility markets.

De-risking and stimulating new technologies

- We will also ascertain our role in crowding private sector investment into critical scale up technologies. We will seek to convert innovation into investable projects that achieve commercial operations.

- We will support focus on technologies with potential to contribute to the UK’s energy mix, with existing route to market, where we can accelerate cost reductions.

- We will enable the UK to establish a global leadership position, putting the UK supply chain (engineering base) in an advantageous position to serve or export.

Onshore Energy - Our approach

Our Onshore Energy function will deliver in phases, leveraging partnerships to establish early wins, whilst also strategically planning for the longer term.

Strategic Partnerships

GBE will work with the public and private sector to accelerate the deployment of onshore renewables and agree commercial models with key landowners.

We will work with key public landowners and developers to create more opportunities for renewable energy projects, including those hosted on public land. In particular, we are developing a partnership with Trydan that will allow us to build our knowledge and capability in onshore development, and help Trydan accelerate onshore energy deployment in Wales.

Phase 1

- Rapidly scale up internal development capabilities.

- Explore early origination projects with controlling stakes, developing partnerships with public landowners and governments.

- Explore opportunities for joint ventures and minority stakes where learnings enhance development.

- Explore investment opportunity to support critical flexibility projects.

Phase 2

- Hold assets into operations, earning steady revenues from the power market.

- Own a range of projects under development, some nearing their final investment decision (FID) from origination.

- Explore renewable aggregator function that delivers savings for public and private partners that are purchasing PV modules.

Onshore Energy - Summary

Why onshore energy?

- Bolster deployment of onshore renewable technologies, unlocking opportunities for project origination on private and public land.

- Build steady, predictable returns in established technologies, balancing risk across our portfolio to enable higher-risk innovative technologies to be pursued.

- Explore opportunities across flexible technologies, providing confidence to the market for complex projects and building domestic expertise in nascent technologies.

How will we differentiate and invest?

- Unlock the public land opportunity, working in partnership with public landowners and mobilising private capital into emerging opportunities.

- Develop, own and operate clean energy projects in established technologies, building expertise, strengthening revenues and delivering benefits for the community.

- Invest capital and share project development to de-risk whilst building capabilities in flexibility markets. Consider our role in mobilising private investment into nascent flexibility technologies to accelerate cost reductions.

Our Partnerships

- We are exploring a partnership with Trydan, which would support its mission to develop 1 GW of new renewable energy capacity on public land in Wales by 2040.

- We will continue to explore other opportunities to build strategic partnerships to deliver onshore energy.

- Where legally permissible, we will work together with the NWF to determine which organisation is best placed to support onshore projects, or whether co-investment is suitable, ensuring public capital is deployed efficiently and its impact is maximised.

Outcomes

- Deliver a cleaner, more secure system that supports economic growth and national resilience.

- Ensure benefits returned to the public will compound over time through reinvestment in further clean energy capacity.

- Achieve GBE’s financial independence while strengthening the value of publicly owned energy assets for future generations.

Priority 3: Offshore energy

Unlock the next frontier in offshore energy – deeper waters and the regional industrial growth it can deliver.

Why Offshore Energy?

GBE will drive momentum in the deep-water offshore wind sector, taking on risk and investments required to unlock growth in the sector.

Context

Offshore wind is expected to play a critical role in the UK’s progress towards net zero, with NESO’s pathways requiring up to 86 GW of installed capacity by 2035, five times current capacity8,10.

Given the scale of deployment required, developers will need to explore opportunities in deeper waters. As the next generation of offshore wind, deepwater developments are expected to build on the success of fixed-bottom offshore wind. Floating platforms or hybrid substructures unlock deployment in offshore locations that are too deep for existing fixed foundations and provide higher and more consistent wind speeds.

The UK is an offshore wind superpower, home to nearly 20% of global offshore wind capacity10,32, which positions us to be leaders in new developments in the sector. There is currently only 277 MW of deep-water wind being deployed globally, 80 MW of which is located in the UK33. However, with confirmed seabed exclusivity enabling 25 GW in development in Scotland, deep-water wind has the potential to play a central role in the UK’s energy mix34.

Deployment of deep-water wind technologies could allow total offshore wind deployment to exceed 100 GW by 2050, making it an important part of achieving carbon budgets in a heavily electrified economy2.

Figure 7: Offshore energy statistics (wind)

Deployment Projections

With rapid scale-up in offshore wind capacity required, it is important to explore all options to delivering, including unlocking the pipeline of deepwater offshore wind projects. Analysis estimates that based on current deployment trajectories, there could be a shortfall in offshore wind capacity of 20 – 38 GW by 2035, compared to NESO’s FES8,14.

Offshore Energy - How will we differentiate?

Globally, over 80% of potential offshore wind sites are in waters deeper than 60 metres35. Seizing the early-mover advantage on deepwater wind offers significant economic benefit. The Floating Offshore Wind Taskforce estimates that building out the UK pipeline of floating projects in deep waters could contribute £47 billion to the UK economy36.

This brings a significant opportunity for jobs, with an estimated 100,000 jobs supported by the UK offshore wind sector by 203037. British engineering excellence in the maritime, defence and offshore industries mean there’s a thriving skills base to build on.

Deepwater wind deployment brings potential for a just transition of fossil fuels jobs into clean energy sectors. Aberdeen, home of GBE’s headquarters, can draw upon its world class expertise in oil and gas, which shares a 60% overlap in skills and capability with these technologies36. The Celtic Sea is also positioned to be a hub for deepwater offshore wind supply chains and development, sited close to Port Talbot and the Port of Bristol.

GBE’s joint roles of project developer and supply chain investor mean we are uniquely placed to coordinate public and private sectors to drive investment across the value chain. This can unlock deepwater projects, which will require component standardisation, specialist vessels and equipment; ports with larger lay down areas, deeper water berths, and heavy-lift cranes.

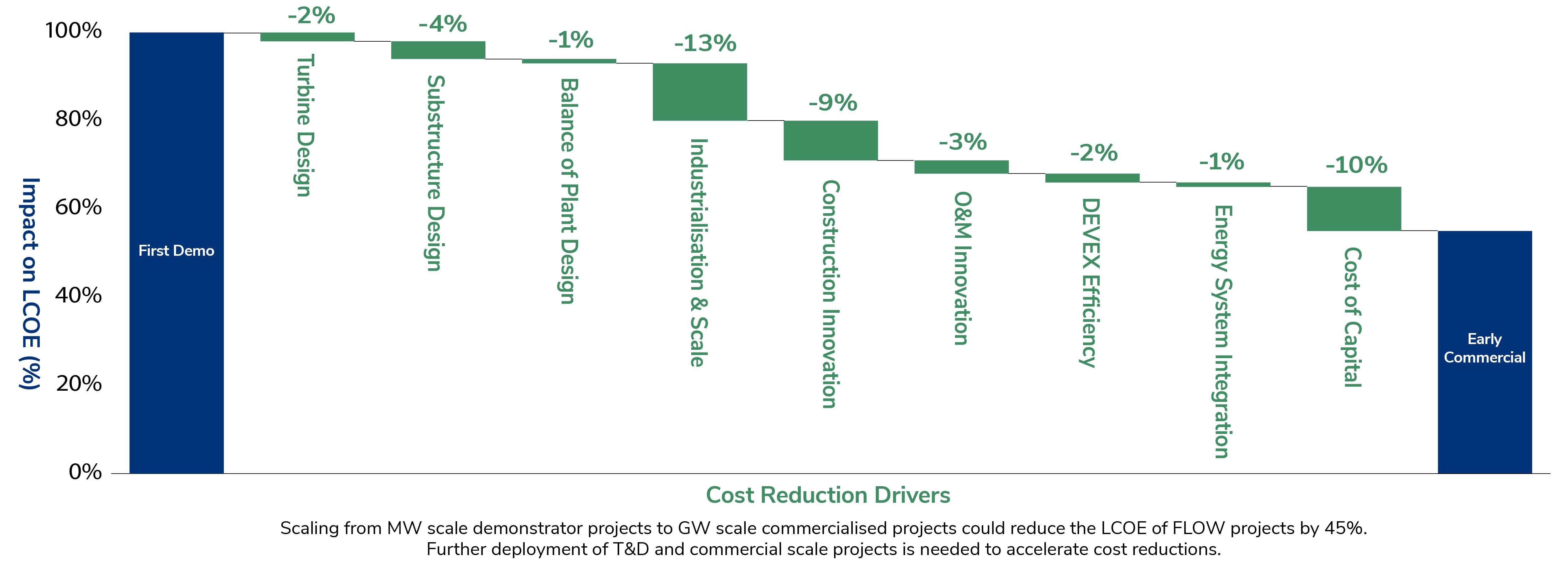

Achieving cost reduction through deployment

Significant cost reductions have been realised in fixed-bottom offshore wind, with Strike Prices reducing by nearly 70% between the first and fourth Allocation Rounds38.

To realise the potential cost reductions in deepwater wind, GBE can support the test and demonstrator (T&D) projects that will enable learning while solving critical engineering challenges around turbine and substructure interactions. Ongoing investment in T&D projects is crucial for testing technologies, refining processes and building confidence, unlocking long-term cost reductions through industrialisation and scaling. The UK has 18 operational fixed-bottom offshore wind farms which are 100 MW or less in size but just two operational deepwater (floating) sites at this scale39.

We can take calculated risks that the market alone will not, backing and de-risking further T&D projects to progress the technology down the cost curve. GBE will support development of deepwater and floating offshore wind supply chains and deployment of further projects to unlock cost reductions, overseeing the transition from the few early deployments already operational to the UK being established as the industry leader in deepwater wind.

Figure 8: Estimated impact of increased deployment on costs of Floating Offshore Wind, Offshore Renewable Energy Catapult40 .

Offshore Energy - Our investment approach

GBE will take a dual approach to address supply chain vulnerabilities and power the next generation of offshore wind in Britain.

Project Investment: Mobilise capital, accelerate deployment

As a technology that has considerable potential to contribute to the UK’s energy mix, GBE will strategically invest in projects where our presence can mobilise wider capital and support deployment.

Strategic Investment

- Support near-term deployment of projects by investing capital to de-risk development projects, mobilising private capital.

- De-risk by signalling our confidence in the technology, supporting longer term deployment, where our involvement can accelerate cost reduction.

Build capabilities through learnings

We will be an active investor in the projects we support. This will mean sitting on project boards and using experience through offshore energy investments to build expertise that informs our other business development and supply chain functions.

Energy, Engineered in the UK: Supply chain building

In parallel with our project development investments, GBE will unlock domestic manufacturing across fixed and deepwater offshore wind supply chains. As part of our £1 billion Energy, Engineered in the UK programme, we will deliver initiatives that reduce supply constraints in fixed-bottom offshore wind, while also positioning the UK to take advantage of the global opportunity presented by venturing into deeper water, delivering the UK’s Industrial Strategy.

Part of the programme will include grant funding through our GBE Supply Chain Fund for constrained components such as cables, monopiles and nacelles, as well as strategic market interventions to deliver high-volume, serialised manufacturing of floating foundations.

Our vision for offshore energy:

- Unlock the UK’s potential as a global design authority for deepwater wind.

- Invest in accelerating the commercialisation and cost reduction of deepwater wind.

- Ensure deepwater wind industrial potential is delivered in the UK, including in Scotland and Wales.

Case study: Pentland Floating Offshore Wind Farm

In November this year we announced investment in Pentland Floating Offshore Wind Farm alongside the National Wealth Fund and the Scottish National Investment Bank, each with the option to invest £50 million.

Pentland Floating Offshore Wind Farm, off the coast of Dounreay in Scotland, will have capacity to generate enough green electricity to power up to 70,000 homes once operational, and is expected to create and support more than 1,000 jobs through its construction and operation.

Offshore Energy: Our long-term approach

We will deliver in phases, leveraging partnerships to establish early wins, whilst also strategically planning for the longer term.

Strategic partnerships

We will work in collaboration with a broader range of partners across the UK to deliver on our ambitious objectives.

These will include:

- Offshore Wind Growth Partnership: We will build on our work with the Offshore Wind Growth Partnership (OWGP) in their role as Delivery Body for the Industrial Growth Plan (IGP) to coordinate funding towards high-impact projects in key supply chain areas.

- The Crown Estate and Crown Estate Scotland: We will continue to work closely with The Crown Estate and Crown Estate Scotland to unlock seabed areas across the UK to accelerate offshore wind development.

Phase 1

- Acquisition of minority stakes in deepwater offshore energy projects to mobilise capital and support projects to commercial operations date (COD).

- Build internal understanding and technical capability in project development of deepwater wind assets.

- Coordinate investment along the supply chain.

- Deepwater Foundations Accelerator Programme Competition to unlock billions of investment in UK supply chains.

Phase 2

- Hold assets into operations, earning steady revenues from the power market.

- Potential to sell down constructed assets and recycle revenues back into the transition.

- Continued development of capabilities across different stages of project development.

- Evolve strategic investment approach into the supply chain, where GBE can make an impact.

Offshore Energy: Summary

Why Offshore Energy

- The UK is home to a significant pipeline of deepwater offshore wind projects. With British engineering excellence and synergies with the oil and gas sector, there is a thriving skills base to enable a just transition of jobs into the clean energy sector.

- Overcoming the engineering and supply chain challenges can unlock deployment and drive down costs. Capturing this early-mover advantage in these technologies could deliver significant economic value to the UK.

How will we differentiate and invest?

- Support test and demonstrator projects, backing emerging technology with calculated risk taking to accelerate cost reductions.

- Support near-term deployment to de-risk and mobilise private investment.

- Coordinate investment along the supply chain, in parallel with our Energy, Engineered in the UK programme, to develop a resilient deepwater supply chain.

Our Partnerships

- Form key strategic partnerships with The Crown Estate and Crown Estate Scotland to unlock seabed areas for offshore wind.

- Build on the partnership with the Offshore Wind Growth Partnership (OWGP) in its role as the IGP Delivery Body, to coordinate public and private sector funding to deliver better outcomes for the public, project developers and investors.

- Where legally permissible, we will work together with the NWF to determine which organisation is best placed to support offshore projects, or whether co-investment is suitable, ensuring public capital is deployed efficiently and its impact is maximised.

Outcomes

- Create and sustain high-quality jobs and apprenticeships in areas of the country that need them most.

- Support workers to move into and across the green economy, building the skilled workforce the UK’s energy transition requires.

- Stimulate new markets and technologies in which the UK can compete and lead globally.

Our portfolio

We will operate across our priority areas to build a portfolio that balances the UK’s short- and long-term clean energy needs, providing social

value while generating a return. We will take a long-term view on our investment and development activity while delivering positive outcomes in the near term.

Our portfolio will be carefully structured to balance risk. We will combine higher risk, high-growth projects with more stable, lower risk investments to ensure both resilience and sustainable returns. We will ensure that our portfolio overall brings a level of additionality, where additionality may refer to clean energy generation, jobs, community involvement or profitable public ownership that would not have occurred in GBE’s absence.

Our approach is about balancing achieving the various aims we have as a company. We recognise that some activities will drive outcomes in one area but be less strong in others. Presented here is our initial approach, which we will evolve as opportunities are presented and market dynamics shift, reassessing where to allocate our capital and resource to ensure we fulfil the range of outcomes we have committed to.

GBE Ventures

Whilst GBE has outlined its core priority areas, we recognise the importance of remaining open to new and emerging opportunities that align with our overarching objectives. The GBE Ventures arm will exist to ensure that we can consider other technologies and projects with clear potential to support achieving our overall mission.

This could include, but is not limited to, other offshore technologies like tidal energy, or technologies that have a wide strategic benefit like carbon capture, utilisation and storage (CCUS), or hydrogen used for electricity storage. Our Ventures arm will operate centrally and sit outside of our three main business areas, taking minority positions in projects and companies that have high growth potential and a strong UK innovation footprint.

Energy, Engineered in the UK

The Statement of Strategic Priorities explains that GBE should focus both on unblocking existing and future supply chain constraints as well as creating well paid, high-quality jobs. Doing so is critical to our mission of public ownership with purpose.

Our £1 billion Energy, Engineered in the UK (EEUK) programme is designed to unlock industrial opportunities from the energy transition and to ensure the UK develops enduring capabilities in the clean energy technologies of the future. The programme will support technologies across the energy sector, and we will make bold, deliberate choices to invest in building long-lasting technology sovereignty, positioning the UK to lead globally.

Our programme will deliver a combination of grants and investments, enabling us to respond to market failures and proactively shape markets as a long-term, patient investor.

- Through our £300m GBE Supply Chain Fund: Offshore Wind and Networks (our first product under Pillar 1), we will deliver grants to increase domestic manufacturing of critical components, alleviating constraints and delivering good jobs across the UK.

- Under Pillar 2, we will deliver strategic interventions to accelerate the commercial deployment of more nascent technologies, starting with deepwater wind.

- Under Pillar 3, we will launch an Investment Fund in Summer 2026, enabling us to take commercial stakes across clean energy supply chains and build the future industries that will underpin the global clean energy transition.

Across each Pillar, we will focus on creating and supporting good, skilled jobs across the UK, working closely with GBE’s Trade Union Advisory Group.

Throughout the delivery of this programme, we will act as a convener, working closely with our strategic partners and taking a ‘Team UK’ approach to solving complex, system-wide challenges.

Ethical supply chains

We are embedding ethical standards across GBE, at the board and operational levels, and through the delivery of Energy, Engineered in the UK. We will develop a comprehensive Supply Chain Risk Framework, overseen by the Senior Accountable Director for Ethical Supply Chains,

Baroness Frances O’Grady. As part of this work, we will engage with industry and civil society to raise standards, explore UK-based alternatives to diversify high-risk supply chains and work internationally to align with leading global partners.

Delivering in collaboration with others

Leveraging public investment landscape to deliver priority areas:

GBE has a distinct, yet complementary role in the wider public investment landscape. We will collaborate with a range of institutions:

National Wealth Fund: Both GBE and NWF will play a role in enabling Clean Energy deployment:

- NWF specialisation: UK’s policy bank, invests capital into a range of clean energy in addition to a range other sectors.

- Our specialisation: UK’s clean energy champion, focused on development, using clean energy investment to support this focus.

The Scottish National Investment Bank: Both GBE and SNIB invest in clean energy projects connected to Scotland:

- SNIB specialisation: Invest to support their Net Zero, Place and Innovation missions.

- Our specialisation: Focused on clean energy project development and supply chains across the UK.

British Business Bank: Both GBE and BBB support smaller businesses and play in enabling Clean Energy deployment:

- BBB specialisation: support SMEs (all UK sectors) to access finance to start & scale up.

- Our specialisation: enables local businesses and communities to unlock the benefits of clean energy.

UK Research and Innovation: Both GBE and UKRI will play a key role in supporting innovation:

- UKRI specialisation: innovate in the way we develop projects and support supply chains.

- Our specialisation: transform research, products & services into commercial successes.

Delivering across our four nations:

We are the nation’s clean energy champion, and we’re committed to delivering value across all four corners of the UK. Through our activities and via our sponsoring department we will work with the devolved governments on matters of devolved competence to ensure we’re delivering value efficiently while reflecting the needs of local people.

We will also work with regional public bodies and schemes, including the Scottish Government’s Community and Renewable Energy Scheme (CARES), Ynni Cymru and the Welsh Government Energy Service, and in Northern Ireland Executive.

Our advisory bodies:

GBE has a distinct, yet complementary role in the wider public investment landscape. We will collaborate with a range of institutions:

- Trade Union Advisory Committees: A forum to engage on key relevant matters relating to skills, jobs and our joint commitment to a just transition.

- GBE Aberdeen Taskforce: Established to provide strategic leadership, community insight and place-based solutions to support the delivery of GBE’s mission in the North East of Scotland.

- GBE Stakeholder Advisory Committee: Composed of senior leaders and experts across the energy industry, trade bodies, and academia, it acts as a feedback mechanism, testing the effectiveness of our delivery.

Collaborating with centres of innovation:

We will collaborate with partners to support sector-leading innovation. In 2013, Innovate UK created a network of Catapults in high growth industries designed to bridge the gap between government, universities, research institutions and innovative businesses of all sizes, to transform great research rapidly into commercial success to support industry and generate economic growth.

- Energy Systems Catapult helps UK businesses benefit from the seismic shift to a cleaner energy system. Its team of over 250 experts draws on leading test facilities, modelling tools and data from over 500 of their research projects to support innovative companies to test, trial and scale new products & services.

- Offshore Renewable Energy Catapult enables innovation and accelerates offshore renewable energy development, growing businesses and creating jobs UK-wide. ORE works to improve technology reliability and enhance knowledge, directly driving the growth of UK economic benefits.

- High Value Manufacturing Catapult is the UK’s manufacturing innovation network. Made up of six specialist innovation centres, it supports companies of every size to thrive, working across industrial sectors to deliver skills, supply chain and technology innovation.

- As part of the HVM Catapult network:

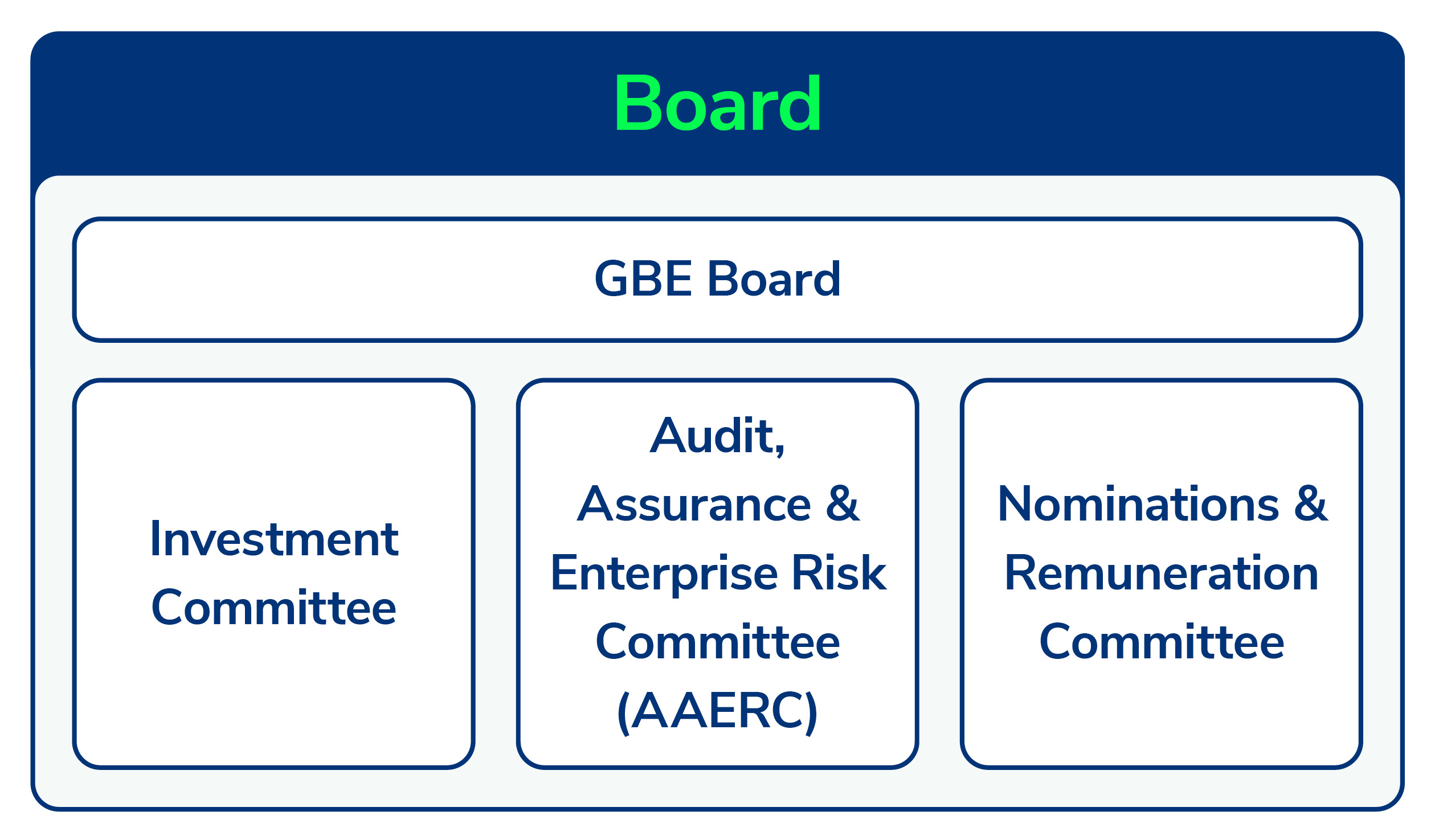

- National Composites Centre is an innovation partner to industry specialising in composite materials and structures and digital engineering.